You know you should be saving more, but every month feels like a guessing game. How much should go to emergencies? What about that vacation you've been dreaming about? And retirement... well, that always gets pushed to "someday." When all your money sits in one account, it's nearly impossible to know what you can actually spend and what you need to protect. So you end up either spending too much and feeling guilty, or hoarding everything and never enjoying life. Neither feels good.

Here's what makes it worse: you work hard for your money, but without a clear system, it just disappears into bills, impulse purchases, and daily expenses. You want to build wealth. You want that emergency cushion. You want to finally take that trip or buy that thing without the guilt. But right now, your savings strategy is basically "hope for the best." And hope isn't a strategy.

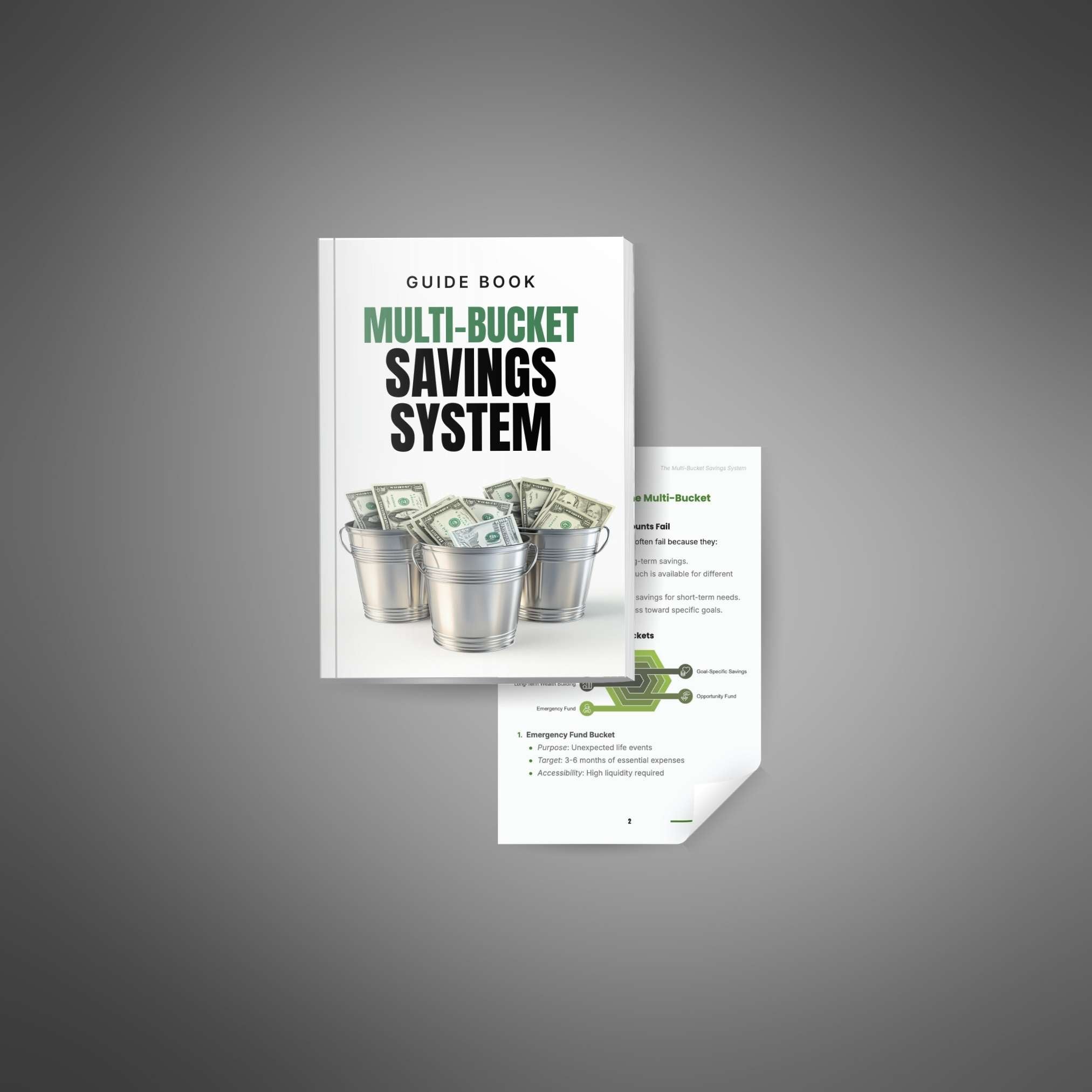

The Solution That Actually Works

The Multi-Bucket Savings System gives you a proven framework to divide your money into purpose-driven categories that align with your real life. Think of it like organizing your closet—when everything has its place, you can actually find what you need and see what you have. This guide walks you through setting up separate "buckets" for emergencies, short-term goals, long-term wealth, and everything in between.

Set It Up Once, Watch It Work Forever

The real magic happens when you automate the entire system. You'll learn exactly how to set up automatic transfers so your money flows into the right buckets the moment you get paid. No willpower needed. No monthly decisions. No forgetting to save. Your emergency fund grows. Your vacation fund fills up. Your retirement account builds quietly in the background. All while you focus on living your life.

Take Control in the Next 24 Hours

This isn't theory or fluff. You get step-by-step instructions for choosing the right accounts, calculating how much goes where, and adjusting your system as your life changes. Whether you're starting from zero or already have some savings scattered around, this guide meets you where you are and shows you the exact next steps. Financial stability isn't about making more money—it's about organizing the money you already have. And that starts right now.